No Down Payment Car Insurance in Texas

Company Trusted For Over 25+ Years*

Call us 1-855-371-6683

Company Trusted For Over 25+ Years*

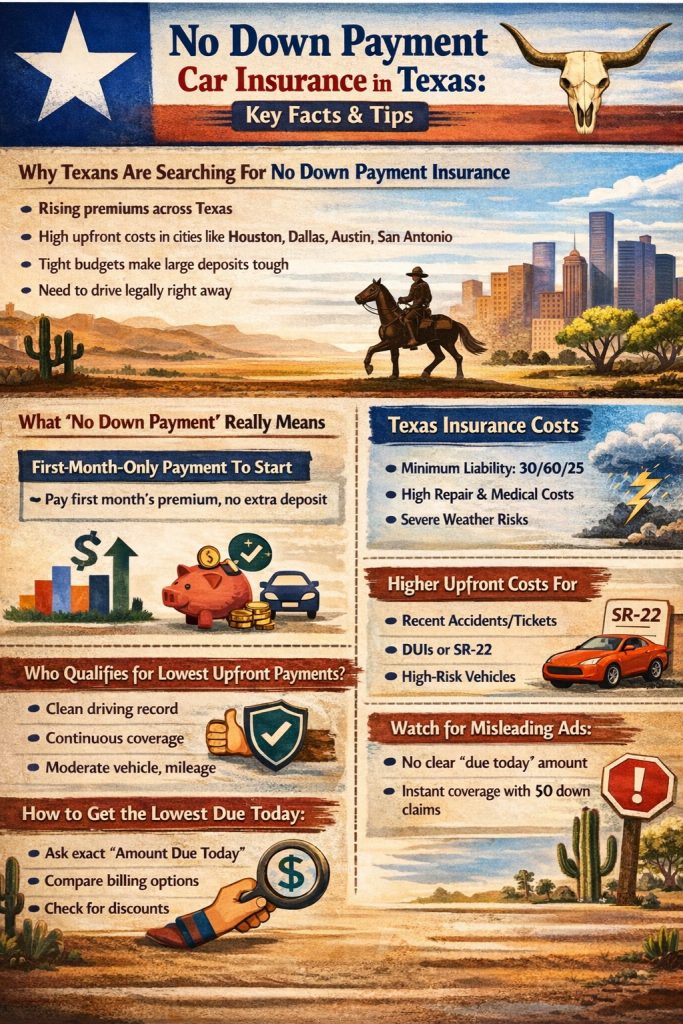

With rates rising sharply over the past few years, many Texas drivers are looking for no down payment car insurance. A no deposit policy doesn’t mean you owe nothing down and can get free coverage for a month. In reality, it means you must make the first installment payment and not an additional amount on top of it. So, a liability-only policy that costs $1,200 per year would require just $100 to activate the policy and get legally covered.

No down payment plans are great for drivers who want legal coverage with as few upfront charges as possible. It might be a little more expensive than paying for the entire policy in full, but for those strapped for cash, it can help a lot.

Savvy Texas drivers are not looking for free insurance. They’re looking for a way to start coverage legally without paying several hundred dollars upfront. Understanding how “no down payment” really works and what insurers actually offer it can make the difference between driving legally today or risking fines, license suspension, and vehicle impoundment.

Auto insurance premiums across Texas have risen sharply due to inflation, higher vehicle repair costs, medical expense growth, increased litigation, and weather-related losses. Vehicles today cost far more to repair because of sensors, cameras, and advanced safety systems, even in relatively minor collisions.

In metro areas such as Dallas–Fort Worth, Austin, and San Antonio, and Houston full-coverage policies frequently exceed $230 to $300 per month for average drivers. For younger drivers or those with violations, costs can climb much higher. When insurers also require deposits equal to 20 to 40 percent of the policy term, the upfront bill can easily reach $500 or more.

For many Texans, that kind of immediate expense simply isn’t possible. Rent, utilities, food, fuel, and medical costs already strain household budgets. Because Texas is a car-dependent state, driving legally is not optional. Lowering the amount due today becomes the priority.

Drivers want the lowest possible cost to start coverage immediately. Insurers must manage risk from the moment coverage begins. The balance between those two realities is where no-down-payment insurance exists.

A common misconception is that no down payment means paying nothing up front. In Texas, that does not exist in legitimate auto insurance. Coverage cannot start without payment because insurers assume immediate financial risk.

In practice, no down payment usually means first-month-only billing. The driver pays only the first month’s premium to activate the policy, without an additional deposit based on the full policy term.

Many insurers require deposits ranging from 10 to 25 percent of the six- or twelve-month premium. A low-down-payment structure removes that deposit and spreads the remaining balance across future monthly payments.

When reviewing quotes, Texans should always separate three numbers: the monthly premium, the amount due today, and whether the upfront amount includes a deposit. Marketing phrases like “$0 down” are often shorthand. The only number that matters is the exact amount required to bind coverage.

Not every insurer markets itself as “no down payment,” but many of the cheapest car insurance companies in Texas regularly allow first-month-only billing for qualified drivers. The key difference is whether the company requires an additional deposit on top of the first month’s premium.

The companies below consistently rank among the lowest-cost options in Texas and are known for offering low upfront payments when the driver profile qualifies.

State Farm frequently comes out as one of the cheapest auto insurance providers in Texas, especially for drivers with clean records and continuous coverage. While State Farm does not advertise “no down payment” insurance, it often allows policies to start with only the first month’s premium due.

💵 State Farm Rates in Texas

Rates depend on location and driving history.

State Farm works best for drivers with a stable insurance history, minimal violations, and vehicles that are not expensive to repair. When approved for monthly billing, the amount due today is often equal to the monthly premium with no additional deposit.

GEICO is one of the most competitive insurers in Texas for liability-only and basic coverage, making it a common choice for drivers focused on keeping both monthly and upfront costs low.

💵 GEICO Rates in Texas

Final rate depends on your vehicle and driver profile.

GEICO often offers monthly installment plans with no separate deposit for drivers who qualify, meaning the first payment may be the only amount required to start coverage. Drivers with good driving habits can further reduce costs through usage-based programs, though participation is optional.

GEICO is especially effective for drivers who want a low upfront payment and prefer managing everything online.

Texas Farm Bureau is a Texas-based insurer that frequently offers some of the lowest full coverage rates in the state. While it requires a low-cost annual membership, the savings often outweigh the fee.

💵 Texas Farm Bureau Rates

This competitive rate can make the first-month payment extremely affordable compared to national competitors.

Texas Farm Bureau is particularly strong for rural and suburban drivers, long-term Texas residents, and households with stable driving records. Monthly billing is often available without a large deposit, making it a strong no-down-payment-style option when approved.

AAA can be a surprisingly affordable option in Texas for drivers seeking liability-only or minimum coverage, especially those who value predictable billing and member benefits.

💵 AAA Texas Rates

AAA commonly allows monthly payments and may not require a separate deposit beyond the first payment for qualifying drivers.

Final rate depends on your driver profile and region.

AAA works well for drivers with modest vehicles, lower mileage, and a preference for working with a traditional organization rather than a purely online insurer.

Progressive is not always the absolute cheapest insurer on paper, but it frequently offers the most flexible payment structures for drivers with tickets, accidents, lapses in coverage, or credit challenges.

💵 Progressive Rates in Texas

Your final premium depends on individual risk factors.

Progressive stands out because it is more willing than many competitors to offer monthly billing without a large deposit for drivers who would otherwise be forced into pay-in-full or high-deposit plans elsewhere. For drivers who do not qualify for the cheapest insurers, Progressive can still provide the lowest amount due today.

While traditional insurers like State Farm, GEICO, and Texas Farm Bureau often allow qualified drivers to start coverage with just the first month’s premium (and no extra deposit), OCHO takes low-upfront insurance a step further by offering $0 down payment options for many Texas drivers.

OCHO is not a direct insurance company – it’s a licensed insurance agency and premium finance platform that partners with established carriers (such as Progressive, Dairyland, Gainsco, National General, and others) to provide quotes and policies. What sets OCHO apart is its interest-free financing: They advance the down payment (or even the full initial amount required by the insurer) on your behalf, allowing you to activate coverage immediately with little or nothing due today.

🔄 OCHO: A Unique Financing Platform

Not a direct insurer • Partners with carriers like Progressive & Gainsco

💡 Ideal For: Drivers facing cash-flow challenges, recent coverage lapses, or who need to activate coverage immediately with minimal funds today.

Note: Underlying premium rates are set by partner carriers. A small broker fee may apply, but no interest is charged.

OCHO is especially helpful for drivers facing cash flow challenges, recent lapses, or higher-risk profiles who might otherwise face large deposits elsewhere. It’s available in Texas and operates fully online/app-based for quick quotes and binding.

If cash today is the biggest barrier, start with OCHO for a quote. The quote is 100% free and super fast. Always compare with direct quotes from top low-upfront insurers to ensure the best overall rate and fit for your needs.

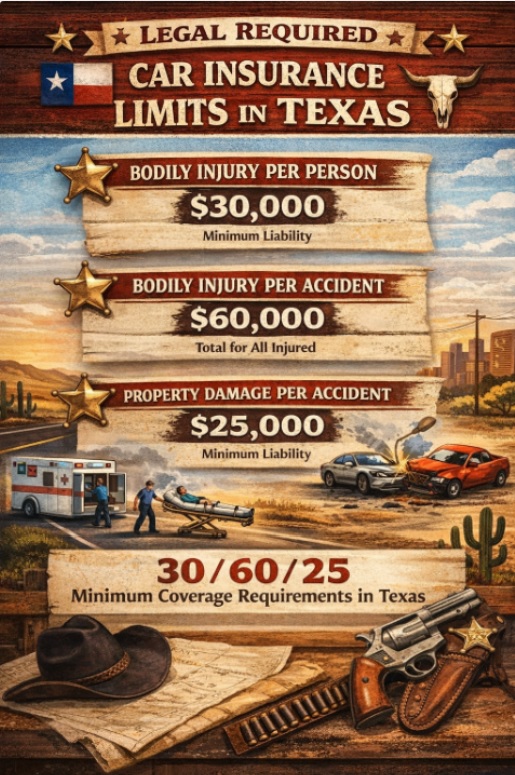

Texas is an at-fault state, meaning the driver who causes an accident is responsible for damages. This structure increases insurers’ immediate exposure, which can influence billing requirements.

Texas minimum liability limits are 30,000 dollars per person for bodily injury, 60,000 dollars per accident for bodily injury, and 25,000 dollars for property damage. While these limits satisfy legal requirements, they are often insufficient to cover real-world accidents involving modern vehicles and medical treatment.

Higher required limits increase potential losses for insurers from day one. As a result, policies with higher limits or added coverages often require more money upfront, even when monthly billing is available.

Texas also requires insurers to offer Personal Injury Protection, known as PIP. Drivers may reject it in writing, but PIP increases the premium and can raise the amount due today. It does, however, provide immediate medical coverage regardless of fault.

Multiple forces are pushing Texas auto insurance premiums higher. Repair costs have surged due to advanced vehicle technology and expensive replacement parts. Labor shortages in the auto repair industry have further driven up costs.

Medical inflation continues to increase bodily injury claim severity, especially in urban areas. Texas also experiences high attorney involvement in auto claims, which raises settlement values and legal expenses.

Weather-related losses play a major role as well. Hailstorms, flooding, and severe weather events routinely produce widespread claims across the state. Insurers must price for catastrophe risk, which affects both monthly premiums and billing terms.

When expected losses rise, insurers tighten underwriting standards and often require more premium upfront to reduce early-term exposure.

When an insurer offers a low-down-payment option in Texas, it typically means there is no extra deposit beyond the first month’s premium. The remaining balance is billed monthly, sometimes with small installment fees.

Eligibility for first-month-only billing depends on several factors, including driving history, coverage level, vehicle value, ZIP code, and insurance continuity. Drivers with clean records, stable insurance history, and moderate vehicles are far more likely to qualify.

Drivers with higher risk profiles often face deposits because insurers want more premiums collected before a potential claim occurs.

Drivers who qualify for the lowest upfront payments usually have continuous prior insurance with no recent lapse. Their driving records show no major violations or at-fault accidents within the past several years. Mileage is moderate, and vehicles are not unusually expensive to repair or steal.

Garaging location also matters. ZIP codes with lower accident and theft frequency typically allow more billing flexibility. While credit-based insurance scoring is used in Texas, it is not the only factor affecting upfront cost. Driving behavior and insurance history often matter more.

Drivers with recent accidents, speeding tickets, or DUI convictions frequently face higher upfront payments. High-mileage commuters, luxury vehicles, and drivers with repeated lapses in coverage also encounter stricter billing requirements.

New Texas residents without prior in-state insurance history may be required to pay deposits until a payment pattern is established. These requirements are risk-management tools, not penalties.

An SR-22 is a certificate filed with the Texas Department of Public Safety confirming that a driver carries the required liability insurance. It is commonly required after DUI convictions, reckless driving, or driving without insurance.

SR-22 policies usually involve higher premiums and stricter billing terms. Many insurers require larger upfront payments or limit installment options. Maintaining clean driving and payment history over time can restore access to standard billing structures.

A 35-year-old driver in suburban Houston with a clean record and a five-year-old sedan might pay around 246 dollars per month for full coverage. If approved for first-month-only billing, the amount due today would likely be close to that same amount.

A 24-year-old Dallas driver with recent speeding tickets and a financed vehicle may face monthly premiums between $325 and $410, with an upfront requirement of $500 or more if a deposit is required.

A 55-year-old rural Texas driver with an older vehicle and low mileage may secure liability-only coverage for $109 per month with minimal upfront cost.

These examples show that driver profile matters more than insurer branding.

Large national insurers often provide flexible billing to qualified drivers, even if they do not advertise it. Regional Texas-focused insurers may also offer competitive payment structures due to local market experience.

High-risk insurers may allow monthly billing when others will not, though often with higher upfront costs. Usage-based and pay-per-mile programs can significantly reduce premiums for low-mileage drivers, lowering the amount due today.

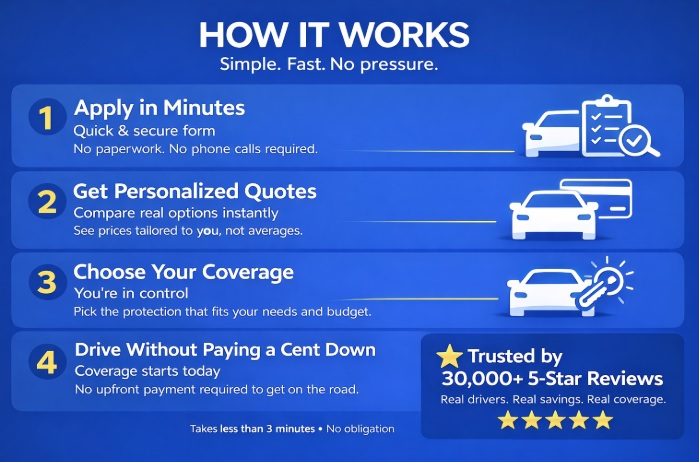

The most important step is asking the right question. What is the exact amount due today to start coverage? Comparing billing structures is just as important as comparing monthly premiums.

Coverage should be chosen intentionally rather than automatically selecting maximum limits. Accurate mileage and garaging information is critical, as errors can raise upfront costs. Asking about autopay, paperless billing, and telematics discounts can also help over time.

Driving vehicles that are cheaper to repair, reducing mileage, and maintaining continuous insurance all support lower upfront requirements. Telematics programs can reward safe driving, and avoiding payment-related cancellations preserves billing flexibility.

These habits compound over time, improving both affordability and insurer trust.

Be cautious of quotes that lack written documentation or clarity about the amount due today. Legitimate insurers provide policy documents, proof of insurance, and transparent billing immediately after payment.

Avoid sellers who cannot clearly explain coverage or request unusual payment methods.

Teen drivers are usually cheapest when added to a household policy. Seniors often benefit from low mileage and a stable driving history. Low-income drivers may qualify for limited assistance programs. Rideshare drivers need special endorsements that increase costs, making the billing structure especially important.

Military families and frequent movers should prioritize continuous coverage to avoid higher upfront requirements.

Non-owner car insurance provides liability coverage for drivers who do not own a vehicle. These policies are typically less expensive and easier to start with low upfront payments, while preserving insurance history.

They are useful for drivers between vehicles or reinstating coverage after a lapse.

First-month-only billing is ideal when cash flow is tight and coverage is needed immediately. While installment fees can slightly increase long-term cost, the flexibility is often worth it.

Drivers who can afford higher upfront payments may reduce total premiums, but the right choice depends on personal finances, not just price.

Texas auto insurance is expensive and evolving, but understanding how billing works gives drivers leverage. A no-down-payment structure does not eliminate insurance costs, but it can dramatically reduce the financial strain of getting insured.

By choosing coverage intentionally, maintaining continuous insurance, and comparing billing terms instead of just the monthly price, Texans can legally get on the road with less money due today and fewer long-term problems. Compare no down payment car insurance plans in Texas in under five minutes. Save more of your hard-earned money with direct rates.