Very Cheap Car Insurance With No Deposit in Florida

Company Trusted For Over 25+ Years*

Call us 1-855-371-6683

Company Trusted For Over 25+ Years*

Finding very cheap car insurance with no deposit in Florida is a tough challenge that drivers face. The Sunshine State has some of the highest insurance rates in the nation, which often makes it difficult for drivers on a tight budget to afford coverage.

The good news is that some companies and programs can minimize how much you pay up front, even if true zero-down car insurance policies are rare. Understanding what “no deposit” really means in Florida, how insurers structure their policies, and what strategies work best for teens, seniors, and high-risk drivers will help you get covered without draining your wallet.

In the auto insurance industry, the deposit is the amount you pay when the policy starts. In most cases, this is equal to the first month’s premium. Some insurers may require more, especially if your risk profile is higher.

Florida law requires all drivers to maintain minimum insurance coverage. As a result, you can expect some out-of-pocket costs regardless of the circumstances. Understanding this distinction is crucial before shopping around. The goal is not to expect to drive away without paying, but to minimize the upfront amount you need to pay to get legally insured in Florida.

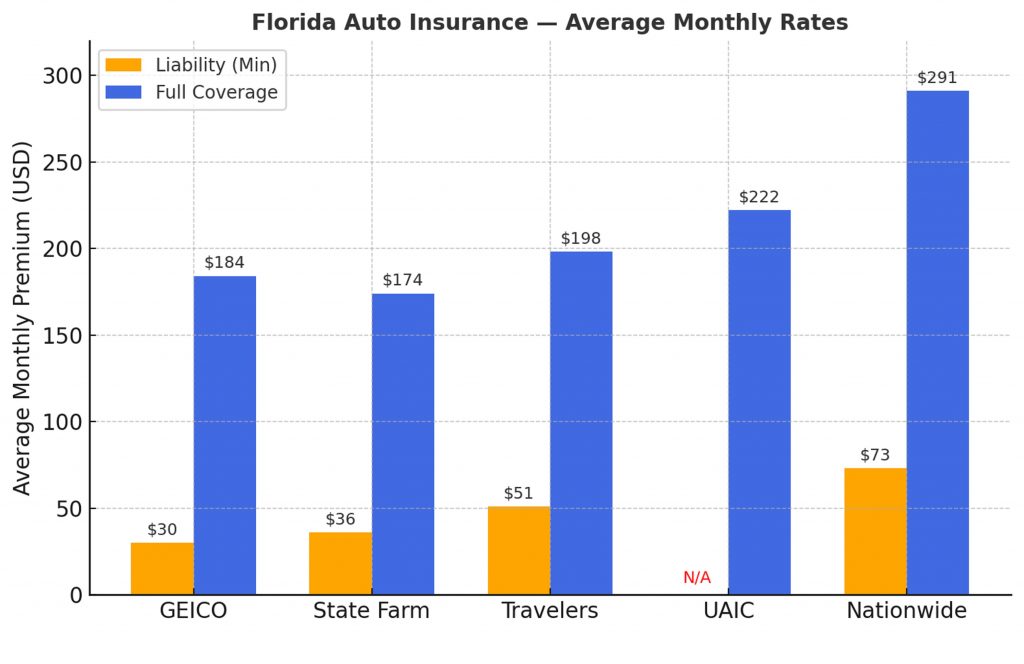

Below is a ranked list of insurers frequently cited in Florida for having the cheapest rates. While auto insurance rates have spiked in recent years, drivers can still find cheap Florida liability insurance, often under $50 a month for qualified drivers.

| Rank | Insurer | Typical Liability / Minimum Rate* | Typical Full Coverage Rate* | Notes on Deposit / Upfront Cost Risk |

|---|---|---|---|---|

| 1 | GEICO | $30/month ($358/year) | $184/month ($2,209/year) | Frequently appears as the lowest liability in Florida. Likely to require the first month or a small deposit. |

| 2 | State Farm | $36/month ($429/year) | $174/month ($2,089/year) | Often the cheapest full-coverage among major carriers. Deposit requirements are usually for the first month. |

| 3 | Travelers | $51/month ($609/year) | $198/month ($2,372/year) | Reasonably competitive in full and partial markets. Moderate deposit. |

| 4 | UAIC (United Automobile Insurance Co.) | — | $222/month ($2,667/year) | More common in higher-risk ZIPs; underwriting is somewhat flexible. |

| 5 | Nationwide | $73/month ($875/year) | $291/month ($3,492/year) | More expensive, but sometimes useful for specific driver profiles. |

| 6 | Root | $120/month ($1,438/year) for minimum | (less data for its full coverage) | Known for usage-based / smartphone apps; may allow lower upfronts in certain cases. |

| 7 | Smaller / Regional or Specialty Carriers | Varies | Varies | These insurers may offer car insurance with the lowest deposits in your area if you qualify, but less consistent rate data is publicly available. |

* “Typical” rates above are based on a clean record, good credit, and in favorable ZIPs in Florida. Your actual rates may vary widely.

On average, minimum coverage costs about $30 per month, or roughly $358 per year, which places it well below most competitors.

GEICO is also known for requiring relatively small upfront payments compared to other large insurers, often limited to the first month’s premium. This makes it appealing to drivers who need coverage quickly without a heavy deposit. In addition to low base premiums, GEICO provides a wide range of discounts for safe driving, multiple cars, good students, and vehicle safety features.

While not always the absolute lowest for full coverage, GEICO consistently ranks among the most affordable for minimum coverage in Florida, and its flexible payment structures help drivers keep deposits as low as possible while maintaining legal protection on the road.

Florida has unique insurance laws compared to most other states. Every vehicle owner must carry at least $10,000 in Personal Injury Protection (PIP) and $10,000 in Property Damage Liability (PDL). PIP covers medical expenses for you and your passengers, regardless of fault, while PDL covers damage you cause to someone else’s property. Florida does not require bodily injury liability coverage for most drivers, though it is strongly recommended because accidents can easily exceed the minimums.

Another important rule is that coverage must be continuous. If you cancel your policy and do not immediately turn in your license plates, you can face fines and license suspension. This makes staying insured, even with limited funds, an absolute necessity.

If you’re looking for very cheap car insurance with no deposit in Florida, you need to understand what “cheap” really looks like in the state, and know Florida’s average insurance costs. Drivers in Florida pay well above the national average due to dense traffic, high accident rates, fraud, and severe weather risks. Full coverage policies often cost more than $3,000 per year, or roughly $250 per month. Minimum coverage averages between $88 and $120 per month, depending on your location and other factors.

Rates vary dramatically by zip code, driving history, age, and type of vehicle. Urban areas such as Miami, Orlando, and Tampa are usually more expensive than rural counties. If you find coverage significantly below the state average, especially with low upfront payments, you are doing better than most Florida drivers.

While no insurer can promise zero money down for everyone in Florida, a few companies are known for offering low deposit structures or flexible payment plans. Large national insurers like State Farm, GEICO, and Travelers frequently provide affordable base premiums and allow customers to spread out payments. Smaller companies like United Automobile Insurance Company and regional Florida carriers sometimes design policies specifically for budget-conscious drivers.

Some agencies and brokers advertise no-deposit policies, but what they usually mean is financing the first payment over the term or allowing you to split it into smaller increments. Daily or weekly pay-as-you-go insurance is also growing in popularity. These models make it possible to activate legal Florida car insurance coverage with only a small initial upfront payment.

Even with companies that advertise no deposit, most drivers in Florida should expect to pay something before coverage begins. For minimum liability coverage, this can sometimes be as low as $20 or $30 with specialized providers. With mainstream insurers, the first month’s premium is almost always required.

For drivers seeking full coverage, the upfront cost is usually higher, often between $150 and $400, depending on the car and the driver’s record. High-risk drivers may face deposits of several hundred dollars. The key is to shop around and ask directly how much is due at the time of purchase, because this number can vary greatly between companies.

Teen drivers face some of the steepest insurance costs in the country, and Florida is no exception. Sixteen-year-olds can pay more than $400 per month for liability-only policies, while seventeen-year-olds often average closer to $300. Full coverage for a teenager can easily exceed $5,000 per year.

The best strategy is to add a teen to a parent’s or guardian’s existing policy rather than buying a standalone policy. This spreads the risk across multiple drivers and vehicles and results in a lower incremental increase. Teens should also take advantage of good student discounts, driver education programs, and usage-based insurance when available. Driving an older, safe vehicle also reduces costs. By combining these methods, families can lower both the total premium and the initial deposit required.

Senior drivers in Florida often enjoy lower rates than teens and young adults, but premiums can begin rising again past age 70 due to age-related risk factors. On average, seniors pay slightly below state averages for liability coverage but may pay slightly more for full coverage.

Seniors should look into safe driver courses that insurers often reward with discounts. Low-mileage discounts are particularly valuable for retirees who drive less frequently. Bundling auto insurance with homeowners’ or renters insurance can also reduce costs significantly. Seniors should also consider choosing vehicles with strong safety features and lower repair costs to keep premiums and deposits low.

One of the best ways to shrink both your monthly premium and your upfront payment is by stacking discounts. Common discounts in Florida include:

By combining several of these, drivers can often reduce premiums by 20 to 30 percent. Lower premiums directly translate to lower deposits because the upfront cost is usually tied to the monthly bill.

If your primary goal is to pay as little as possible up front, there are a few proven steps to follow. First, decide whether you can accept liability-only coverage, since it is always cheaper upfront than full coverage. Second, get quotes from insurers that advertise low or no deposit options, and ask specifically how their payment plans work. Third, consider micropayment models that allow you to pay daily or weekly, which can be easier to manage for those with limited cash flow.

Adjusting your policy start date to line up with your paycheck cycle can also help. Finally, always ask about discounts and installment fees, since these can make the difference between a manageable deposit and an unaffordable one.

High-risk drivers in Florida, including those with accidents, tickets, or poor credit, often face higher premiums and larger deposits. Insurers view these drivers as more likely to make claims, so they protect themselves by requiring more money up front.

If you fall into this category, your best bet is to shop with nonstandard insurers that specialize in high-risk coverage. These companies may still allow smaller deposits but expect higher monthly payments. Improving your credit score, keeping a clean driving record, and waiting for violations to fall off your history are the long-term solutions to reducing both premiums and deposit requirements.

Technically, yes, but usually with conditions. Most insurers require at least the first month’s premium to activate coverage. Some agencies may finance or spread out this payment, making it feel like zero down.

It often does. Insurers may charge higher monthly premiums or add financing fees. Still, the trade-off can be worth it if you need immediate coverage with limited cash.

Florida requires 10/20/10 minimum coverage, which includes $10,000 PIP and $10,000 PDL. Bodily injury liability is optional for most drivers, but recommended.

It is more difficult. High-risk drivers usually face larger deposits and premiums, though some nonstandard insurers may offer more flexible terms.

Yes, but their base premiums are often high due to risk factors. The no-deposit structure only lowers the upfront cost, not the total yearly expense.

Yes. Insurers in Florida use credit-based insurance scores. Poor credit can mean higher premiums and larger deposits. Improving your credit will directly lower your costs.

Florida’s insurance market is expensive, and true zero-deposit car insurance is rare. The cheapest overall premiums often come from large insurers with broad discounts, while the lowest upfront car insurance deposits are usually offered by smaller agencies or companies with flexible payment models.

Teens benefit most from being added to family policies and using good student discounts. Seniors should focus on low-mileage and safe driver savings. High-risk drivers may need to work with nonstandard insurers or take steps to improve their credit and driving record.

By understanding how deposits are structured, comparing quotes from multiple companies, and stacking every available discount, drivers can get very cheap car insurance with no deposit in Florida. Get your free online quote today and save hundreds with direct rates.