Direct Car Insurance

Company Trusted For Over 25+ Years*

Call us 1-855-371-6683

Company Trusted For Over 25+ Years*

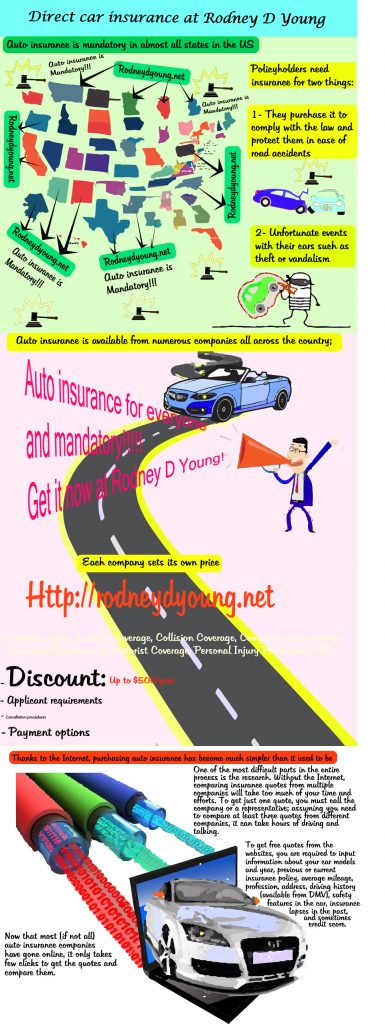

When people talk about direct car insurance, they most likely refer to the Direct Auto & Life Insurance. Auto insurance policy, as a product, has always been a peculiarity. It is mandatory in almost all states in the US, but the buyers never expect to make use of it for the obvious reasons. Policyholders need insurance for two things: they purchase it to comply with the law and protect them in case of road accidents or other unfortunate events with their cars such as theft or vandalism.

Auto insurance is available from numerous companies all across the country; each company sets its own price, coverage types, discounts, applicant requirements, cancellation procedures, and payment options. This is a good example of a case where an abundant of option does not always mean a good thing. More often than not, the available choices overwhelm rather than ease the buyers’ minds. Let us not forget that auto insurance policy is a complex agreement which involves too many little details most people find difficult to understand.

Thanks to the Internet, purchasing auto insurance has become much simpler than it used to be

One of the most difficult parts in the entire process is the research. Without the Internet, comparing insurance quotes from multiple companies will take too much of your time and efforts. To get just one quote, you must call the company or a representative; assuming you need to compare at least three quotes from different companies, it can take hours of driving and talking. Now that most (if not all) auto insurance companies have gone online, it only takes few clicks to get the quotes and compare them. Some independent websites, for example, Rodney D Young, even provide computerized calculation to compare multiple quotes almost in an instant.

To get free quotes from the websites, you are required to input information about your car models and year, previous or current insurance policy, average mileage, profession, address, driving history (available from DMV), safety features in the car, insurance lapses in the past, and sometimes credit score. The data field varies from one company to another. Once you input all those data, your insurance quote is ready within few minutes. Another good thing is that the websites are open 24 hours a day, seven days a week; it means you can access them anytime from home even during weekend or holidays. The process is so simple that it should take no more than an hour to get free quotes from half a dozen of companies at a time. Free quotes are printable too, so you can take a closer look at the details and discuss both the advantages and drawbacks with your families.

This company is a fine example of a major insurer that has gone online with their products. This move allows the company to provide streamlined and simpler procedures for both new and old customers to access their policies. Coverage options available from the company include:

One of the best things about Direct Car Insurance is that it does not discriminate. It provides all coverage options for all drivers regardless of their driving history. Apart from the aforementioned, the company also offers two more coverage options including Roadside Assistant and Accidental Death Coverage.

Existing policyholders can access their policy status and payment schedules via direct general login, while new customers need to register first. With Direct Auto & Life Insurance you can set your own payment schedule and the amount of down payment in accordance to your personal preferences. Everything is accessible online, so you can check all the data anytime you need. It is also possible to file claims via the website because the portal is always open. If you are a new customer, you’ll be pleased to know that the company does not ask for driving history or credit score. For high-risk drivers, however, there can be different coverage options and available discounts. In the event you find difficulties with login or issues with the policies, you can also call Direct Auto Insurance number at 1-877-463-4732.

In case you are wondering where is the location of Direct Auto Insurance near me, the official website of the company offers a Find a Store. It is a map with clear markings on the office locations all across the country. Depending on your address, one of their offices can be just about few hundred meters from your home. Direct Auto & Life Insurance has more than 400 offices all over south and southwestern parts of the country.

Direct Insurance quotes are available for everyone including non-policyholders

The quotes are provided free of charge, and you can use them as a reference or for comparison purpose. Please understand that quotes are just approximation of the premium rate based on the data you give. Insurance company determines your rate based on various factors, and sometimes it is just impossible to put a number of certain factors for examples how secure car safety features are and how careful you are as a driver. You may change the amount of deductible as well which can reduce the premium. Purchasing auto insurance directly from the company saves a considerable amount of money since there is no independent agent or middleman in the process. However, there is nothing wrong with hiring an agent to reduce the hassles on your part. The agent does all the research, comparison, and necessary checks on your behalf to help you save more money and get the best possible coverage package.