Cheap Liability Car Insurance in Atlanta

Company Trusted For Over 25+ Years*

Call us 1-855-371-6683

Company Trusted For Over 25+ Years*

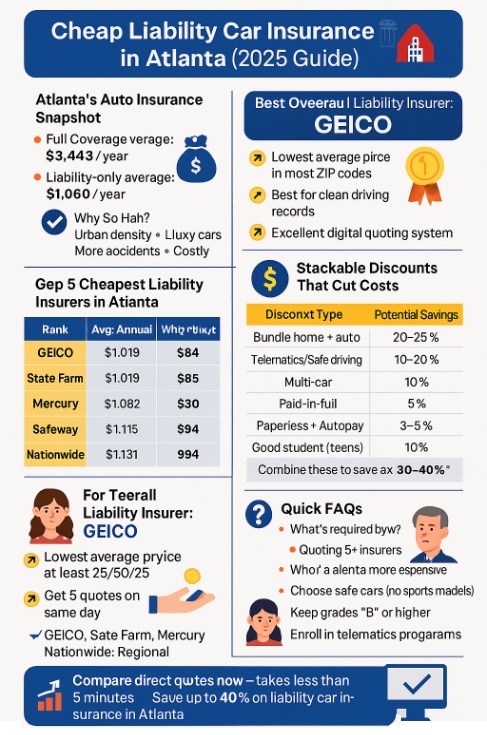

Atlanta has some of the highest auto insurance rates in all of Georgia. The average cost of full coverage insurance is $3,443, or approximately $287 per month. The high cost of coverage has prompted many drivers in Atlanta to seek cheaper rates. Some drivers have opted for cheap liability-only car insurance in Atlanta.

Rates for liability-only policies are way cheaper. Average annual rates are about $1,060 or $88 a month. While it’s risky to have lower coverage levels, many drivers in Atlanta can only afford liability insurance.

Georgia law requires 25/50/25 liability at a minimum,$25,000 bodily injury per person, $50,000 per accident, and $25,000 property damage, so you’ll be legal at those limits. But in a metro where luxury vehicles are common and injury claims can escalate quickly, most drivers should consider higher bodily injury limits even while they keep a sharp eye on cost.

While every driver’s risk profile is unique, patterns emerge in large datasets. Across Atlanta ZIP codes, national carriers with efficient pricing engines routinely surface near the top for minimum coverage, and a few regional or specialized carriers occasionally undercut everyone for specific profiles.

A recent city-level breakout shows GEICO leading the pack for many Atlantans, followed by State Farm, Mercury, Safeway, and Nationwide when you look strictly at minimum-coverage price points across standard driver assumptions. The key insight is that these carriers compete hard for entry-level liability customers—and they each bring different discount levers, quoting portals, and appetite for driving histories.

| Rank | Company | Avg. Annual | Est. Monthly | Why It’s Often Cheap in ATL |

|---|---|---|---|---|

| 1 | GEICO | $1,008 | $84 | Aggressive pricing for clean records; strong online quoting |

| 2 | State Farm | $1,019 | $85 | Consistent renewals; good multi-line value for homeowners |

| 3 | Mercury | $1,082 | $90 | Competitive in urban ZIPs; responsive to garaging and mileage |

| 4 | Safeway | $1,115 | $93 | Non-standard appetite can price below market for some drivers |

| 5 | Nationwide | $1,131 | $94 | Bundling strength; stable rates in many metro ZIPs |

Among them, GEICO usually ranks as the overall cheapest for most clean-record drivers. State Farm, though slightly higher in base cost, often wins over households with multi-line discounts and exceptional claims handling. Mercury appeals to budget shoppers in dense ZIP codes, while Safeway and Nationwide bring strong local availability and stability.

🥇 Best Overall: GEICO Insurance

That said, regional carriers like Georgia Farm Bureau or Country Financial sometimes slip below national players when offering limited-time rate filings or loyalty-based pricing. And for those who qualify for multi-policy discounts, State Farm or Nationwide can easily take the lead once bundling is factored in.

Each underwrites differently. A clean record with short mileage might favor one, while a multi-car home with telematics could swing another. The lowest quote is only real if you compare simultaneously under identical conditions.

Buying cheap liability coverage here isn’t just about hitting “get quote.” It’s about building a strategy. Start with the right coverage floor: the legal minimum (25/50/25) might make sense for low-value vehicles, but upgrading to 50/100/50 can protect you from financial fallout without much price difference.

Next, collect quotes from five insurers within the same hour. Pricing fluctuates daily, and you’ll only get meaningful results if every quote uses the same parameters—driver, vehicle, ZIP code, and coverage level.

Once you have your quotes, look for telematics programs like GEICO’s DriveEasy, Progressive’s Snapshot, or State Farm’s Drive Safe & Save. If you drive mainly during daylight and avoid hard braking, these programs can deliver 10–20% savings after a few months.

Payment habits also matter. Paying in full saves you monthly installment fees and often earns an additional discount. Enrolling in auto-pay and paperless billing trims even more. Finally, review your rates twice a year. Insurers refile rates constantly based on local claim trends, and a quote that was mid-tier in April could be the cheapest in October.

Discounts are where Atlanta drivers close the gap between average and affordable. Bundling home or renters insurance with auto is the single biggest lever, especially for property owners in Fulton or DeKalb County. Combine that with a clean driving record and telematics enrollment, and your rate can drop by hundreds of dollars annually.

Add paid-in-full, paperless, and multi-car discounts, and you’ll often see cumulative savings near 30–40%. The visual below shows how much these common discounts can trim a typical Atlanta liability policy:

The best strategy is to stack discounts logically. Consider starting with the biggest multipliers (bundle, telematics, clean record) and finishing with smaller percentage-based offers. Every point counts when the city’s baseline premiums run high.

Teens are the most expensive group to insure, and Atlanta’s crowded traffic patterns amplify that risk. The easiest way to reduce costs is to keep your teen on a family policy instead of starting a new one. That way, they share your multi-car and good-driver discounts.

Start quotes with GEICO and State Farm—both known for competitive Atlanta youth rates—then compare Progressive and Nationwide, which tend to offer generous telematics bonuses for safe teen drivers. Encourage your teen to enroll in these programs and to maintain a “B” average to qualify for the good-student discount.

Avoid insuring high-performance vehicles. Insurers view powerful cars as risk multipliers, while modest sedans with modern safety tech lower the base rate. After one or two clean policy renewals, rates typically drop sharply as driving history builds. With patience and consistent monitoring, most families can tame the initial teen surcharge within 18–24 months.

Seniors often face rising rates after age seventy, but Atlanta drivers can counter this trend with proactive habits. Begin by checking for mature-driver course discounts—State Farm, GEICO, and Nationwide all recognize approved defensive-driving classes. These courses can reduce liability premiums for several years at a time.

Lower annual mileage also helps, especially if you’re considering pay-as-you-go car insurance. Many retirees drive less than 6,000 miles annually; reporting this accurately can move you into a lower-risk rating tier. Vehicles with modern safety technology—lane assist, adaptive cruise, automatic braking—can also yield small but cumulative savings.

If you’ve lived at the same address for years, loyalty and bundling matter. Seniors who pair auto and homeowners policies with the same insurer often see premium drops near 20%. For most, maintaining coverage continuity, avoiding unnecessary claims, and reviewing discounts yearly is enough to keep liability rates below $1,200—well under the city average.

Atlanta’s car insurance market isn’t cheap, but a smart strategy beats averages every time. Start by quoting GEICO, State Farm, Nationwide, Mercury, and Progressive on the same day. Use telematics programs to earn real-time discounts, bundle with renters’ or homeowners’ insurance, and re-shop regularly as insurers update their rate filings.

Though Atlanta’s premiums sit above Georgia’s average, the disciplined driver who compares, bundles, and drives safely can pay hundreds less per year than the city norm, without cutting corners on protection. Whether you’re a new teen driver or a retiree enjoying more free time, the path to affordable liability coverage in Atlanta starts with information, timing, and strategy. Get your custom Atlanta car insurance quote in less than five minutes. Save hundreds with direct rates.