Best Buy Car Insurance

Company Trusted For Over 25+ Years*

Call us 1-855-371-6683

Company Trusted For Over 25+ Years*

With rates increasing, many drivers are looking for the best buy car insurance to save the most money. Best buy car insurance goes far beyond choosing the cheapest quote you see on the screen.

The real challenge is balancing low premiums with high-quality coverage, strong claims service, and a company that won’t leave you stranded when you need them most. Drivers often discover that the lowest-priced policy ends up being the most expensive choice once a claim is filed, because low-cost companies may offer fewer protections, slower claim handling, or strict repair limitations.

The goal here is not simply to find the cheapest policy. The goal is to find the best buy car insurance policy for the most affordable price.

Most people begin shopping for car insurance by comparing prices, but price tells only part of the story. The insurance industry assigns risk differently across companies, and the same driver can receive a quote for $95 from one insurer and $160 from another. These differences occur because each company weighs factors like your age, credit history, past claims, homeownership, job type, and ZIP code differently. This means that your best buy insurer is the company that sees you as a low-risk driver compared to everyone else, not necessarily the company that is cheapest for someone else.

To find the best auto insurance, the first step is understanding exactly what you need. This means reviewing your financial situation, how much protection you want for your own vehicle, how much you drive, and what risks you face in your area. Drivers in large cities may prioritize higher comprehensive coverage because theft and vandalism rates are higher, while drivers with long highway commutes may want stronger liability protections because high-speed accidents can cause more expensive damage.

The biggest mistake people make when shopping for insurance is assuming their state’s required minimum liability coverage is enough. State minimums often cover only a fraction of real-world accident costs. A simple rear-end collision with an expensive vehicle can exceed a state’s minimum property damage coverage by tens of thousands of dollars, leaving the driver personally responsible for the rest. For this reason, most financial planners and insurance analysts recommend carrying at least $100,000 in bodily injury per person, $300,000 per accident, and $50,000 in property damage liability.

If your car is valued at more than $4,000 or is still being financed, full coverage is almost always the better financial decision. Full coverage includes liability, collision, and comprehensive insurance. Collision covers damage from hitting another object, while comprehensive covers non-collision incidents like theft, flooding, fires, hail, animal strikes, and falling objects.

Optional add-ons are also an essential part of understanding value. Features like roadside assistance, rental reimbursement, new car replacement, accident forgiveness, and OEM parts coverage can significantly improve your protection for only a few dollars per month. Different insurers price these add-ons differently, so what is expensive with one company may be cheap with another.

Once your coverage needs are clear, the next step is comparing quotes the right way. You must match coverage levels across insurers exactly, including deductibles, liability limits, and add-ons. Otherwise, you end up comparing different products, and the cheapest option may simply be offering weaker coverage. Consistent comparison is the only way to see which company is truly giving you the best deal for the same level of protection.

Getting car insurance quotes is much easier today than it was even a decade ago, but many drivers still use only one quoting method and end up missing out on better pricing. The best approach is a multi-step strategy that lets you see both large price ranges and precise final premium calculations.

Online comparison sites are a great place to start because they quickly show how insurers differ in pricing. They gather dozens of quotes based on your location, vehicle, and driving history. These websites are ideal for identifying the cheapest companies for your general profile, but their quotes are not always exact. They often show estimated ranges rather than official prices and may not include certain discounts that are available only through direct insurers.

After seeing price ranges, the next step is to visit individual insurer websites to get official quotes. Companies like GEICO, State Farm, Progressive, Allstate, Nationwide, and Travelers provide instant, accurate quotes that reflect real underwriting rules and available discounts. These quotes also ensure you’re comparing consistent coverage levels, something comparison websites sometimes overlook. Direct-insurer quotes tend to be far more reliable and give you the actual price you’d pay if you purchased the policy.

For drivers who need more specialized coverage, such as SR-22 filings, high-risk policies, or multi-vehicle bundles, local insurance agents can often find options not shown online. Agents have access to regional insurers and specialty providers that don’t advertise heavily, and these smaller companies can sometimes offer surprisingly competitive rates. Working with an agent also helps drivers who prefer personalized service or who want a professional to help choose coverage limits and discounts.

Combining all three methods, comparison sites, direct quotes, and local agents, gives you the most thorough picture of what insurers will actually charge. Drivers who use all three typically save more than drivers who use only one.

Some insurers consistently offer strong pricing and value across a wide variety of drivers. Below is a detailed look at several companies widely regarded as best-buy candidates because of their balance of price, coverage, discounts, financial strength, and customer satisfaction.

GEICO is frequently one of the lowest-priced insurers for a broad range of drivers. It offers affordable premiums, generous discounts, and one of the most intuitive digital platforms in the industry. The company excels in providing simple, straightforward policies with strong liability and full-coverage options. While GEICO does not offer as many optional add-ons as some competitors, it performs exceptionally well for drivers seeking dependable coverage at a competitive price.

State Farm has a reputation for excellent customer service, strong local agent support, and competitive premiums. The company tends to be especially affordable for safe drivers and for those bundling home and auto insurance. State Farm’s claims process is efficient, with a high satisfaction rating in most states, and the company’s financial strength is among the best in the industry. This makes it a strong best-buy choice for drivers wanting both convenience and reliability.

Progressive is known for its flexible pricing system and for being one of the best options for high-risk drivers. It offers several unique features, including the Name Your Price tool and accident forgiveness options. Progressive also provides competitive SR-22 rates, making it a best-buy choice for drivers who have a past DUI, at-fault accident, or other violations. It also offers strong digital tools and customizable full-coverage options.

USAA consistently provides some of the best rates and highest customer satisfaction scores in the entire industry, but membership is limited to military personnel, veterans, and their families. For those who qualify, USAA is often the clear best-buy option because of its low premiums, excellent claims service, and a robust set of coverage options.

Nationwide offers strong bundling discounts and extensive add-on choices. It tends to be an excellent value for homeowners and for drivers who value high-quality claims support. Nationwide’s telematics programs are also popular with low-mileage drivers seeking to reduce their premiums.

Travelers offers a wide variety of coverage options and upgrades, making it ideal for drivers who want customizable policies. The company is known for good pricing on full coverage, especially when combined with multi-policy discounts.

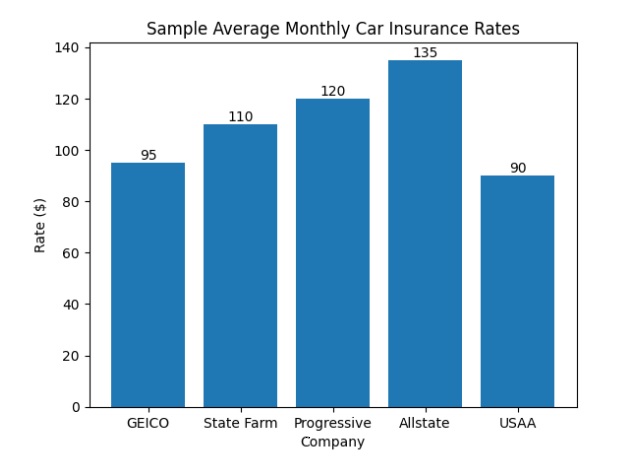

Below is a sample of how average monthly rates differ among major insurers.

| Company | Average Monthly Premium |

|---|---|

| GEICO | $95 |

| USAA | $90 |

| State Farm | $110 |

| Progressive | $120 |

| Allstate | $135 |

These numbers illustrate how dramatically different insurers can price the same driver.

Getting cheap car insurance involves combining the right insurer with the right strategy. Pricing depends heavily on personal factors, but there are several ways to reduce your premiums without sacrificing protection.

Keeping a clean driving record is the strongest long-term strategy because violations can increase rates by hundreds of dollars per year. Improving your credit score also lowers premiums in most states. Choosing a higher deductible reduces monthly expenses as well, especially on full-coverage policies.

Many insurers offer significant discounts for bundling auto with home, renters, or life insurance. Other discounts include safe driver programs, low-mileage programs, military benefits, and student discounts. Some insurers also offer telematics programs that track your driving behavior and reward safe habits. These can reduce rates significantly if you avoid hard braking, speeding, and nighttime driving.

Even with discounts, the cheapest insurer for you depends on your state and driving profile. This is why comparing multiple quotes is essential.

The best place to get quotes depends on your situation. If you want speed and broad comparisons, use an online comparison site. If you want accuracy and full detail, get quotes from insurer websites. If you want human guidance or need help with SR-22 filings or bundle discounts, speak with a local agent.

Most drivers find the lowest overall premium by combining these approaches. Start with comparison sites to see general ranges, visit direct insurers for official prices, and talk to an agent if your situation is more complex.

Drivers needing SR-22 insurance face higher premiums, but some companies provide better value than others. Progressive, GEICO, and State Farm tend to offer competitive rates for drivers needing an SR-22 filing. These companies also have streamlined processes for quickly filing the form with the state, which helps drivers reinstate their licenses sooner.

SR-22 drivers should compare quotes more frequently, because prices can drop significantly after violations age off their record.

Yuma, Arizona, has moderately priced car insurance rates compared to other Arizona cities. The area sees fewer insurance claims than Phoenix or Tucson, leading to lower premiums. GEICO, State Farm, and Progressive tend to offer the most competitive rates in Yuma.

Average rates in Yuma are shown below.

| Coverage Type | Average Monthly Cost |

|---|---|

| Minimum Liability | $58 |

| Full Coverage | $148 |

Regional insurers like SafeAuto can also be competitive for drivers seeking bare-minimum liability coverage.

When buying a car from a dealership, you must have insurance before you can drive off the lot. If you already have an active policy, most insurers automatically extend temporary coverage to new vehicles for up to 14 to 30 days. If you do not have insurance, you can purchase a new policy online in about ten minutes.

You will need the vehicle identification number (VIN), your driver’s license, and your address. Once the policy is purchased, the insurer can email proof of coverage directly to the dealership.

For private-party purchases, the process is similar. Insurance must be active before driving the car home, even for a test drive.

The best way to buy insurance is to determine your coverage needs first, then gather multiple quotes using consistent coverage levels. Once you have accurate prices, compare the companies not only by cost but also by claims satisfaction ratings, financial stability, available discounts, and how well their coverage fits your situation.

Paying the policy in full can save 6 to 12 percent because most insurers charge installment fees. Setting up automatic payments can also reduce costs.

If you want extra protection, consider add-ons like rental car reimbursement and roadside assistance. These are typically inexpensive and provide meaningful value if your car is ever damaged or undrivable.

Teen drivers usually face the highest premiums, and companies like State Farm and GEICO tend to provide the best value for young drivers. Seniors often receive favorable pricing from companies like GEICO or AARP-affiliated insurers. High-risk drivers may find Progressive more forgiving than other major companies.

Military families almost always find the best value with USAA due to its combination of low rates, excellent claims service, and exclusive discounts.

Your driving profile has a significant impact on which insurer provides your best buy option. What works for a clean-record driver in Arizona may not work for a high-risk driver in Florida.

Insurance pricing varies widely from state to state. Factors include accident frequency, medical costs, repair prices, litigation rates, and weather risks. Below is a look at several states and which insurers tend to offer the strongest value.

| State | Best Buy Insurer | Typical Monthly Cost |

|---|---|---|

| California | GEICO | $108 |

| Texas | State Farm | $112 |

| Florida | Progressive | $149 |

| New York | GEICO | $162 |

| Arizona | GEICO | $103 |

| Nevada | Progressive | $138 |

Local insurers also play a major role. For example, Erie Insurance offers some of the lowest rates in Pennsylvania and Ohio, while Texas Farm Bureau is extremely competitive in Texas.

A good full-coverage policy provides comprehensive protection for newer or higher-value vehicles. GEICO and State Farm tend to offer competitive pricing for full coverage, while Travelers and Allstate provide more customization for drivers who want tailored protection.

Drivers should review their deductible levels carefully. A higher deductible reduces monthly premiums but increases out-of-pocket costs during a claim. Choosing a deductible that matches your financial comfort level is essential.

Minimum coverage is the cheapest option but provides limited protection. GEICO, State Farm, and USAA offer some of the most competitive minimum-coverage rates in most states. Minimum coverage is best for drivers with older vehicles worth less than $3,000 or for those who need short-term coverage while budgeting for a better policy later.

Drivers should be aware that minimum coverage may not be enough to protect their finances during a serious accident. Many accidents exceed minimum liability limits, leaving the driver responsible for the remainder.

Discounts can significantly reduce insurance costs. Some of the most valuable discounts include safe driver programs, multi-policy bundling, paying in full, and completing defensive driving courses. For students, good-grade discounts can make a big difference. Low-mileage drivers also benefit from usage-based insurance programs.

Below is a table of typical savings.

| Discount Type | Average Savings |

|---|---|

| Safe Driver | 10–25% |

| Multi-Policy | 15–28% |

| Pay in Full | 6–12% |

| Low Mileage | 5–20% |

| Good Student | 10-15% |

Combining several discounts often results in meaningful total savings.

Insurance rates are affected by many factors, including your age, driving history, credit score, ZIP code, vehicle type, and annual mileage. Newer and more expensive vehicles tend to cost more to insure because repairs are more expensive. High-risk ZIP codes with more accidents or thefts also have higher premiums.

Your insurance history matters as well. Lapses in coverage can significantly raise prices because insurers see them as a sign of financial instability or higher risk.

Drivers with luxury vehicles often find the best value from insurers like Allstate or Travelers because they offer OEM parts coverage and specialized repair networks. Electric vehicle drivers may receive better rates and coverage options from Progressive because of its experience with EV claims. Owners of older vehicles usually find better pricing with GEICO or State Farm because these insurers offer low-cost liability options.

Many drivers choose the cheapest policy without realizing it lacks essential coverage. Others set deductibles too high or fail to compare enough quotes. Some drivers forget to update their insurer after major life changes, such as moving, changing jobs, or adjusting their annual mileage. These oversights can cost hundreds of dollars per year.

Another common mistake is ignoring claims satisfaction ratings. A cheap policy is useless if the insurer delays or denies legitimate claims.

Shopping for insurance every 12 months can help you stay on top of pricing changes. Improving your credit score lowers premiums in most states. Bundling home and auto policies often provides significant savings. For drivers with clean habits, telematics programs offer a way to reduce premiums through safe driving.

Asking insurers about discounts that are not advertised can also help. Some companies offer loyalty or professional discounts for certain employers, occupations, or memberships.

The best buy car insurance is the policy that gives you the strongest protection for the lowest possible price based on your unique situation. By understanding your coverage needs, comparing consistent quotes, reviewing discounts, and choosing insurers with strong claims reputations, you can protect yourself financially while keeping your monthly premiums affordable.

Compare the best car insurance quotes online and save hundreds by buying direct.