Free Auto Insurance Quotes

Company Trusted For Over 25+ Years*

Call us 1-855-371-6683

Company Trusted For Over 25+ Years*

One of the most important benefits of them all is the availability of free auto insurance quotes. Thanks to the Internet, people no longer need to spend hours after hours to drive around in town or make phone calls with insurance agents from all over the place just to get proper insurance rates. A lot of auto insurance companies take their business online, and this brings a lot of advantages for drivers who want to purchase or renew insurance policies.

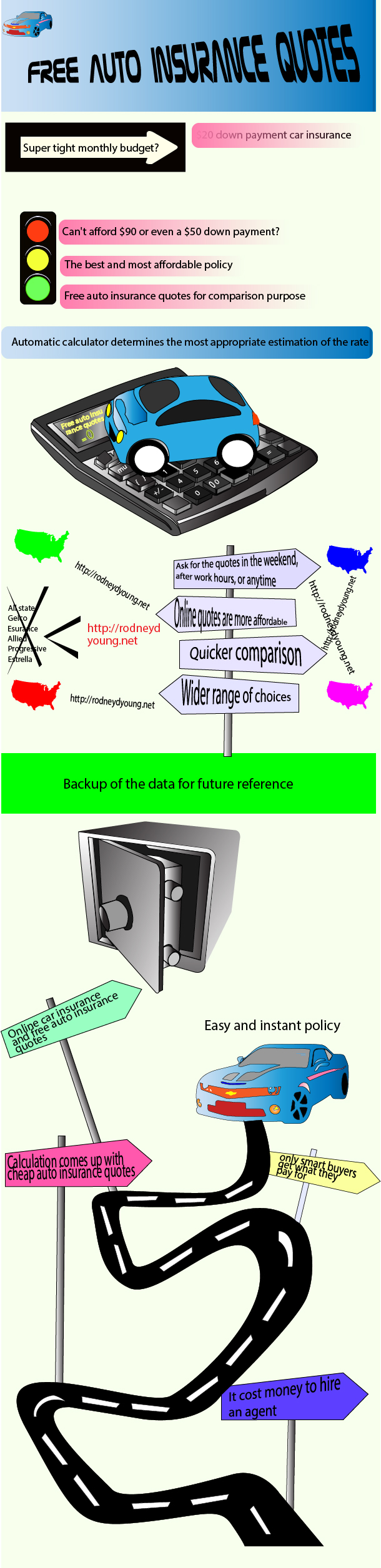

Most (if not all) insurance companies who offer online methods of transaction also provide cheap car insurance quotes for all customers. It means they can get almost instant approximation of their rates in accordance with personal data and coverage preferences. A customer can input numerous data about his/her car (model, make, and year), profession, average mileage, previous policy, accident history, and basically the information from DMV record into the company’s website. Automatic calculator then determines the most appropriate estimation of the rate for that person. The entire process takes only minutes and is available free of charge.

There is no limitation on how many websites or companies to visit

A customer can generate dozens or more of free auto insurance quotes for comparison purpose; within an hour, it is not impossible to get tens of quotes from many different companies in one area. Some websites even allow visitors to generate multiple quotes from numerous companies at a time, after which they can compare the rates and find the best and most affordable policy for their needs; Rodney D Young website is fine example of that.

Another major advantage is that almost all online forms are easy to use

The interface is straightforward enough that even the most tech-ignorant person can understand how to start the calculation process. Insurance quotes are often available in printable format too, so anybody can have a backup of the data for future reference. There is no time or day limitation either; unlike brick & mortar insurance offices or agencies, the website is open 24 hours a day, seven days a week. Anybody can ask for the quotes in the weekend, after work hours, or anytime they feel comfortable.

It is also possible to modify the data in the form

The insurance rates for two different car models are not the same; for example, a customer who has two cars but wants to register only one of them can change the data to get different rate approximation.

For many people, a discussion with an insurance agent is more comprehensive than online registration. However, the latter does bring plenty of additional benefits in addition to time efficiency alone for examples:

It is not necessary to meet face-to-face with company’s representative just to ask for free auto insurance quotes. In most cases, customers do not event have to visit the company to make payment and receive proof of insurance.

Online car insurance and free auto insurance quotes options offer plenty of advantages indeed, but every customer needs to understand that it still requires research to make good decision. Similar to all products, some auto insurance policies are not as good as expected; only smart buyers get what they pay for. The absence of insurance agent means the customers need to do research on their own without help from professionals. As a rule of thumb, customers must always read the policy and all the fine details in it before they accept the agreement and make payment.

Another important thing to consider is coverage

Just because the calculation comes up with cheap auto insurance quotes, it does not always mean the best deal. Double check the data in the form for inaccuracies; if the rate is too good to be true, it probably is. Cheap rate can also mean incomplete coverage, so make sure to check if all necessary coverage types exist in the quote.

The most effective way to reduce insurance rate is to purchase only the necessary coverage. Insurance companies offer both basic (mandatory) and optional coverage for customer; more optional coverage translates to more expensive premium. It is important that customers use the same data to compare the quotes.

Auto insurance policy is only as reliable as the company which provides it

Check the company’s reputation from online testimonials or its financial stability from independent reviewer website. Strong financial stability refers to the company’s ability to provide payout for every claim. Policyholders purchase insurance to get financial protections for their assets, and it is good to know that the company has the resources to deliver.

Online auto insurance is not a complex procedure

The more difficult part of the process is research. If there is any doubt about insurance terms, coverage types, discounts, or issues with claims, it is good to ask for assistance from professional independent agent. It cost money to hire an agent, but at least the customers can minimize financial losses due to incorrect data input, improper comparison, or unnecessary coverage.