No Down Payment Car Insurance in Florida

Company Trusted For Over 25+ Years*

Call us 1-855-371-6683

Company Trusted For Over 25+ Years*

With rates on the rise, many Florida drivers are searching for “no down payment car insurance.” The cost of full coverage auto insurance in Florida is $321 a month or $3,852 per year. Liability policies are a lot cheaper, with average rates of $88 or $1,056 annually.

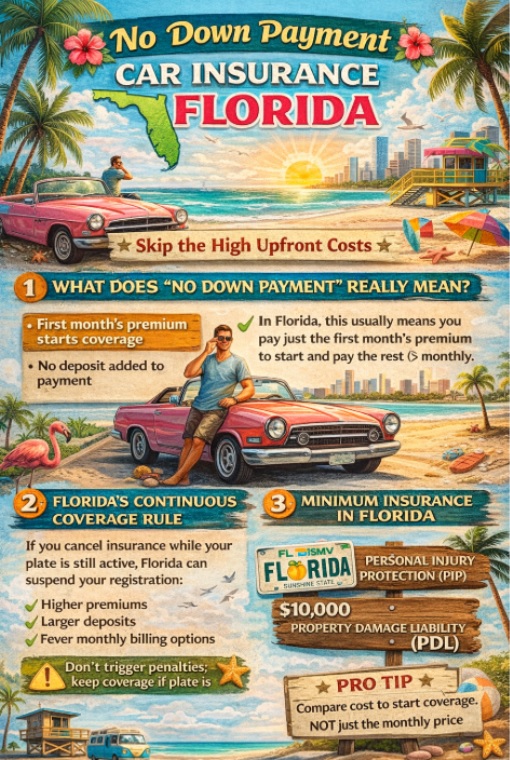

Drivers looking for no down payment car insurance in Florida want legal coverage with minimal upfront costs. For qualified drivers, this usually means paying only the first month’s premium rather than an additional deposit.

This guide explains what no down payment car insurance really means in Florida, how Florida’s laws affect your options, which insurers are typically the cheapest for low upfront costs, and how to avoid misleading “$0 down” ads.

Florida is consistently one of the most expensive states for auto insurance. Rising repair costs, higher medical expenses, dense traffic patterns, weather losses, and complex claims all push premiums upward.

In cities like Miami, Orlando, Tampa, and Fort Lauderdale, even minimum coverage can feel expensive. When insurers also require deposits or large initial payments, drivers feel boxed in.

A true zero-dollar policy does not exist with legitimate auto insurance. Coverage begins immediately, and insurers must collect payment before assuming risk.

In Florida, “no down payment” almost always means first-month-only billing. You pay the first month’s premium to activate coverage, without an additional deposit based on the full policy term.

Some insurers require 10 to 30 percent of the policy cost upfront. First-month-only plans eliminate that extra charge and spread the remaining balance across future payments.

When shopping, ignore marketing slogans and ask one clear question:

“What is the exact amount due today to start coverage, and does it include a deposit?”

That question alone prevents most surprises.

Florida’s insurance requirements differ from many states because Florida uses a no-fault system for injury claims.

To legally register a vehicle, Florida drivers must carry:

• $10,000 in Personal Injury Protection (PIP)

• $10,000 in Property Damage Liability (PDL)

PIP pays for a portion of your medical expenses after a crash, regardless of fault. PDL covers damage you cause to someone else’s property.

Florida typically does not require Bodily Injury Liability for most drivers at registration. However, that does not mean it’s risk-free to skip it. If you cause injuries that exceed no-fault thresholds, you can still be personally responsible.

Minimum coverage can reduce the upfront cost, but it also limits protection.

Florida strongly enforces continuous insurance tied to vehicle registration. Cancel insurance while your plate is still active, and you may face penalties or suspension issues.

This matters because drivers with coverage lapses often lose access to low-down-payment billing. A lapse can result in:

• Higher premiums

• Larger deposits

• Fewer insurers are willing to offer monthly billing

If you secure a first-month-only plan, protecting it is critical.

Repair costs continue to rise as vehicles rely on advanced electronics and safety systems. Medical expenses increase injury claim severity. Dense traffic corridors raise accident frequency. Weather events regularly damage vehicles across the state.

When insurers expect higher losses, they tighten underwriting and billing. That’s why Florida drivers often face higher upfront requirements than drivers in many other states.

Low-upfront plans usually work like this:

• First month due today

• Remaining balance billed monthly

• Possible installment fees

The upfront amount varies based on risk. Factors that commonly raise the due-today number include:

• Tickets or accidents

• Insurance lapses

• New or high-value vehicles

• High-risk ZIP codes

• Adding comprehensive and collision

Billing structure matters just as much as price.

Drivers most likely to qualify for first-month-only billing typically have:

• Continuous prior insurance

• Clean or mostly clean records

• Stable addresses

• Moderate mileage

• Vehicles that are not costly to insure

These profiles signal lower early-term risk to insurers.

Higher upfront costs are common for:

• Drivers with recent accidents or tickets

• DUI history

• New drivers

• Drivers with recent lapses

• Financed or leased vehicles requiring full coverage

• High-risk ZIP codes

This explains why two people can receive vastly different “due today” quotes from the same insurer.

Florida uses FR-44 filings for certain DUI cases. FR-44 requires higher liability limits than standard coverage, which increases premiums and often triggers stricter billing rules.

Drivers with FR-44 filings frequently face larger upfront payments and fewer monthly billing options. Avoiding lapses is critical, as restarting coverage can worsen the situation.

A person with a clean driving history may start a full-coverage policy with an upfront payment close to or equal to the monthly premium. For example, if the policy costs $2,400 annually, activating it would only require $200, the first month’s installment payment.

A young driver in a high-risk city with tickets and a financed vehicle may face both high monthly premiums and a required deposit.

A driver with a lapse may see a manageable monthly rate, but a large upfront charge designed to reduce insurer risk. It’s important to note that in Florida, “due today” reflects risk as much as price.

These insurers are often among the lowest-cost options in Florida and frequently allow monthly billing when drivers qualify.

GEICO is often one of the cheapest options for minimum coverage in Florida. Lower base premiums often translate into lower first payments when monthly billing is available.

Best For: Minimum Coverage

State Farm frequently offers strong value for full coverage, especially for drivers with stable records. Competitive pricing can reduce both monthly and upfront costs.

Best For: Full Coverage (Stable Drivers)

Direct Auto can be competitive for drivers who don’t qualify for standard-market pricing. It is often used by drivers who need legal coverage quickly with a manageable upfront cost.

Best For: Non-Standard / SR-22 Needs

Nationwide can be affordable for certain Florida driver profiles and may offer stable monthly billing without extreme deposits when qualified.

Best For: Specific Qualifying Profiles

Travelers can price well for mature drivers with clean records, depending on location, and sometimes offers reasonable billing structures.

Best For: Mature, Clean Records

Maintain continuous coverage.

Drive a practical vehicle.

Avoid claims and violations.

Consider telematics if you’re a safe driver.

These habits improve both pricing and billing flexibility over time.

Be cautious of quotes that hide fees, won’t show written details, or pressure immediate payment. Legitimate insurers can clearly explain coverage and provide proof of insurance immediately after payment.

Florida teens can save big bucks by having their parents put them on their policy. Seniors benefit from a long insurance history. Low-income drivers may need minimum coverage, but should understand the risk. Rideshare drivers need endorsements that increase cost and upfront requirements.

For drivers searching for no down payment car insurance in Florida, non-owner car insurance can be one of the most affordable and practical options available. Non-owner policies provide liability coverage when you drive a vehicle you do not own, such as a borrowed car, rental, or a vehicle shared with family or friends. Because these policies only cover liability and do not insure a specific vehicle, they typically come with much lower monthly premiums. In many cases, drivers can start coverage by paying just the first month’s premium, making non-owner insurance a strong fit for those trying to avoid a large upfront payment.

Non-owner car insurance also plays an important role in maintaining continuous coverage, which directly impacts how much you pay for insurance in the future. Insurance companies often charge higher rates or require larger deposits when drivers have coverage gaps. By carrying a non-owner policy, you stay insured without the cost of owning a vehicle, which can help you qualify for better billing options and lower down payment requirements later. For Florida drivers who need legal coverage at the lowest possible upfront cost, non-owner car insurance can be a smart stepping stone toward more affordable auto insurance overall.

First-month-only billing is ideal when cash is tight and coverage is urgent. While installment fees can increase long-term cost slightly, flexibility often matters more.

Florida’s insurance system is strict, expensive, and unforgiving of lapses. A true zero-dollar policy doesn’t exist, but first-month-only billing often does for qualified drivers.

Focus on the exact amount due today, compare multiple quotes, and review policy billing structures. Also, make sure to avoid lapses and choose coverage deliberately. That approach gives you the best chance to stay legal without a massive upfront hit. Check for no down payment car insurance policies where you live in under five minutes. Save hundreds today with direct rates.