Very Cheap Car Insurance No Deposit

Company Trusted For Over 25+ Years*

Call us 1-855-371-6683

Company Trusted For Over 25+ Years*

Are you currently needing very cheap car insurance no deposit for your vehicle? Are you in a tough financial situation and need to cut back on basic expenses like auto insurance? Do you need to get covered but don’t have the savings to pay the ins premium in full? Maybe you need to get insurance now pay later?

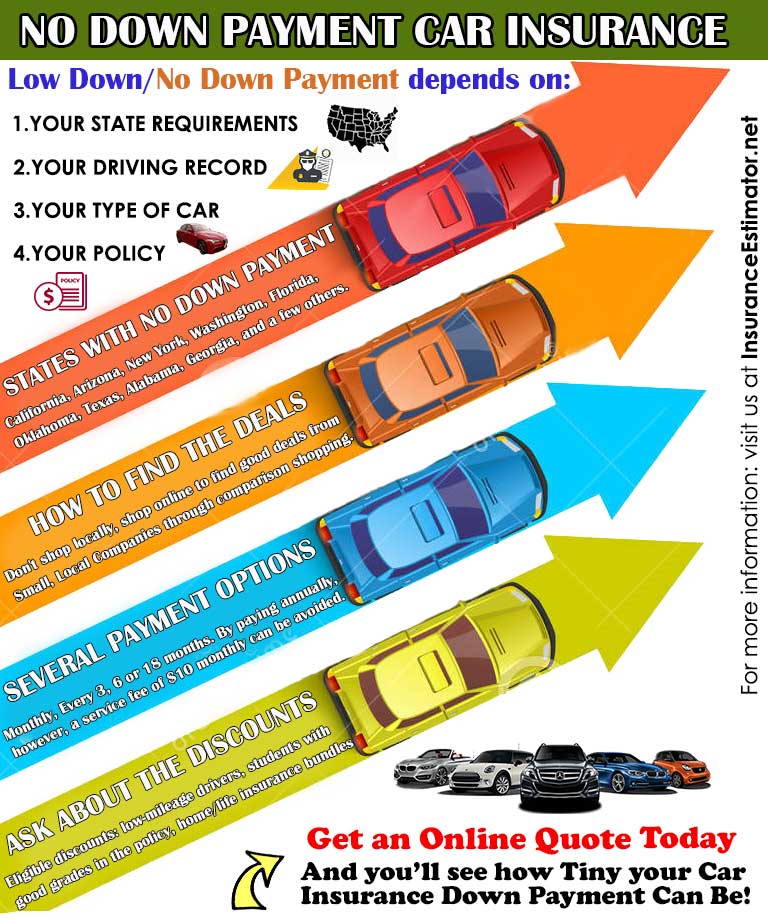

The good news is securing low-cost coverage with nothing down is possible, but you have to do some homework to get the best deals. You need free rate tools from sites like ours, that allow you to compare all the best $0 down insurance deals. You can compare regional and national insurers best rates in less than 5 minutes with most direct carriers. Here are some simple tips that will help you get insured for nothing down, while also maintaining the coverage you need.

If you have an automobile and plan to drive it, you’re going to need to get it insured. Each state has insurance departments that set the laws, including coverage limits. While you can’t control whether or not you can buy insurance, you can control how much you pay for it, and who you choose as your insurer.

You need to purchase at least the minimum legal liability in your state, which is also called “bare bones” coverage. While state laws mandate all drivers carry a minimum amount of liability insurance, you probably will need better coverage. Liability only coverage can end up costing you a lot of money if you get into an expensive wreck that is ruled your fault.

This is not true at all. You can buy very cheap car insurance no deposit for collision and comprehensive coverage. If you have a leased vehicle or it is financed, you will be required to carry collision and often comprehensive insurance.

While more insurance protection translates into higher premiums, there are still numerous insurers that will offer nothing down and monthly payment plans, which still makes it a good deal.

If you choose a plan with no deposit, you can expect your policy rates to be 15% to 20% higher. From a money-saving standpoint, it makes sense to pay your 6 month or 12-month premium in full if you can afford it. For many consumers struggling just to get buy, a no down insurance policy is a necessity.

Someone may be starting a new job and won’t get paid for a month. Others might have put down a big deposit on a new vehicle, leaving little leftover for automobile insurance. Whatever the case, there are numerous direct insurers that will customize your coverage with plans that require no deposit.

When searching for auto insurance, you need to first and foremost think about getting the proper coverage. If you have considerable assets that need to be protected, then low limit liability insurance will probably not be a good idea. You need insurance that covers your assets so you are protected financially, in the event you get into a serious, costly accident.

For new autos, it makes sense to buy comprehensive coverage that includes theft protection. You can get covered for less than $50 per month from online insurers even when you’re getting a very cheap car insurance no deposit or with a tiny down payment. You will also probably need to break up your premiums into monthly installments.

Nearly all of the national carriers have convenient payment plans that can be set up at no additional charge. Some offer $20 down payment car insurance plans. Most insurers even have automatic withdrawal payments that you can set-up, so your bill can be paid each month on the day you choose, with your credit or debit card.

If you don’t feel comfortable being on an automatic payment plan, you can pay online at your convenience using your smartphone, tablet or laptop. Your bank or credit card info can be stored, so paying your monthly premium can take less than a minute.

Pay as you go car insurance lets you break up the cost of your premiums over 6 or 12 equal monthly installments. While it’s just a bit more expensive than paying in full up-front, it lets consumers on a budget get covered, when they otherwise could not afford auto insurance.

Finding a no-down insurance deal takes less time than you might think. Here are a few things you need to do before you can get quoted.

Now that you have gathered all your information together, you’re ready to start comparing quotes. While some car insurance companies that don’t require a deposit will only give you their specific price, other sites will quote you up to 10 rates, from national providers.

In less than 5 minutes you can compare multiple insurers best rates and then decide if you want to buy. There is no obligation to buy a policy and your personal information will not be sold to a third party. You can even select the type of plan you want online, like cheap monthly payments. Once you enter your specific details and desired coverage, you are ready to get the cheapest rates with zero down auto insurance.

There will be a lot of variance in pricing, which is why you want to review as many quotes as possible. Some insurance companies specialize in older adults, over 55, while others give lower rates to those with good driving records. Always make sure you’re truthful with all the personal information you enter. If you drive more than 1,000 miles monthly, don’t be misleading and enter less than 800 miles per month. If your insurer finds out you lied on the application, your policy may get canceled or your rates may go up.

The best deals on auto insurance are almost exclusively found online. There are inherent cost advantages to doing business on the web, and these cost savings are passed down to consumers, by way of lower rates. If you need instant car insurance with no deposit, then you should apply online with direct providers.

This means bypassing agents that get large commissions and getting direct price quotes. There are several carriers that only sell direct, like Esurance, Direct General and Good 2 Go Insurance company.

Not only can you get car insurance with no upfront payment, but you can easily buy and manage your policy online. This means you can start off with a zero down insurance plan and then when it is time for your policy to renew, you might be in the position financially to pay for your premium in full and save a bit.

Most sites also allow you to print your insurance I.D. cards online and manage your claim. So not only do you save money by going direct, but also your valuable time. Get started and apply for cheap internet auto insurance and see how easy it is to save hundreds with direct pricing.

Feel free to check out other sites for more info about very cheap car insurance no deposit