Cheap Liability Car Insurance In Illinois

Company Trusted For Over 25+ Years*

Call us 1-855-371-6683

Company Trusted For Over 25+ Years*

Auto insurance rates across the country have climbed sharply, and Illinois has not been spared. In 2025 alone, average premiums jumped by nearly 18%, driven by inflation, higher repair costs, medical expenses, litigation trends, and an increase in uninsured drivers. Many people are dropping full coverage and opting for cheap liability car insurance in Illinois.

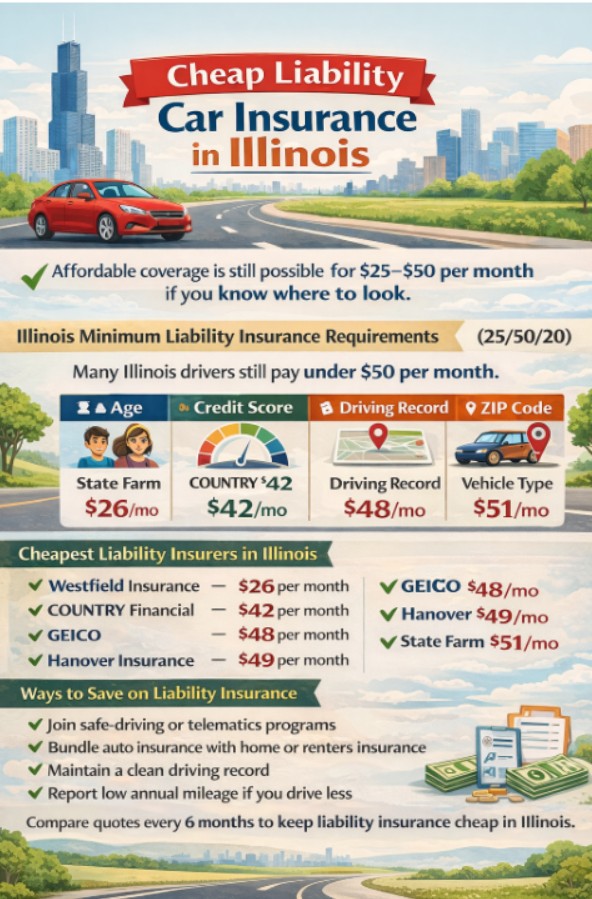

The good news is that thousands of Illinois drivers are still paying under $50 per month for liability-only car insurance. Some pay even less than that. The difference usually comes down to understanding how Illinois insurance works, choosing the right coverage limits, targeting the cheapest insurers for your profile, and stacking discounts most drivers never ask about.

This in-depth guide walks you through everything you need to know to secure cheap liability car insurance in Illinois. You’ll learn the state’s minimum requirements, how much liability coverage really costs, which insurers consistently offer the lowest rates, and how teens, seniors, and everyday drivers can cut premiums without risking legal trouble or financial disaster.

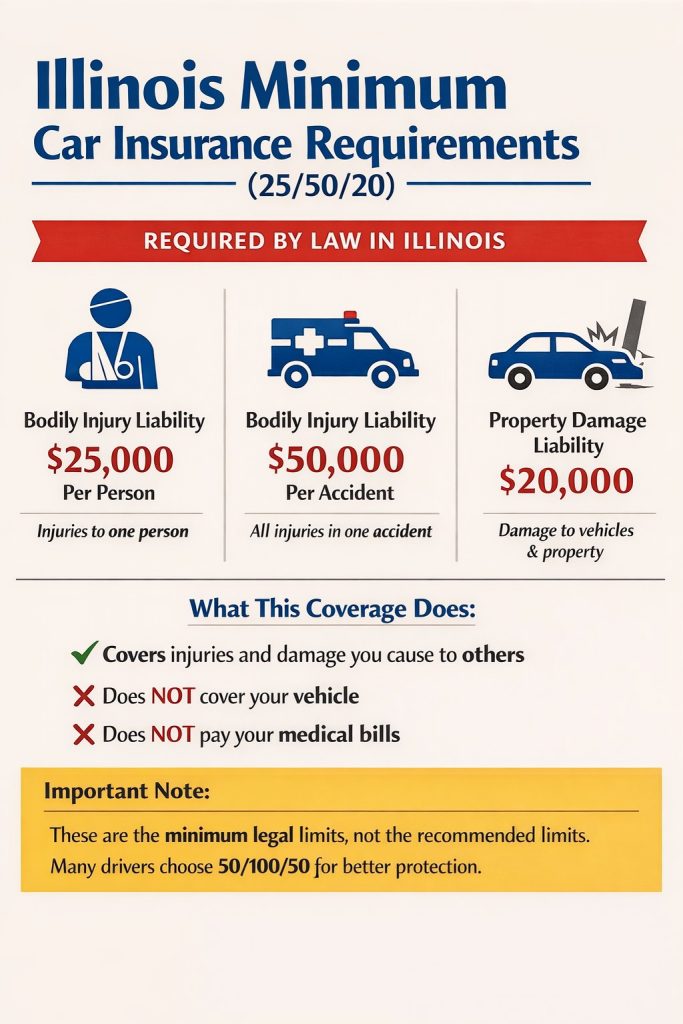

Illinois law requires every registered driver to carry liability insurance. This coverage exists to protect other people, not you. If you cause an accident, liability insurance pays for injuries and property damage suffered by the other party. It does not pay to repair your own vehicle.

The minimum liability limits in Illinois are often written as 25/50/20. This means:

$25,000 for bodily injury per person

$50,000 for bodily injury per accident

$20,000 for property damage

These limits satisfy Illinois law and are the cheapest legal option for most drivers. However, minimum coverage comes with serious risks. A single hospital visit or newer vehicle repair can easily exceed these amounts, leaving you personally responsible for the remaining balance.

Many Illinois drivers choose to increase their limits to 50/100/50. This upgrade often costs less than ten dollars per month but provides double the bodily injury protection and more than twice the property damage coverage. For drivers with assets, savings, or a steady income, higher limits can prevent wage garnishment or lawsuits after a serious crash.

On average, an Illinois driver with a clean driving record and good credit pays about $58 per month, or roughly $696 per year, for liability-only insurance. That figure represents a statewide average, not a guarantee. Actual premiums vary dramatically depending on personal and geographic factors.

Drivers in rural southern Illinois often pay far less than those in Chicago, Cicero, or Aurora. A 35-year-old driver with no tickets and strong credit may see quotes in the $30–$45 range, while a teen driver in Cook County can face rates three times higher.

The biggest pricing factors insurers use in Illinois include:

A credit score alone can increase Illinois liability premiums by more than 40%. Drivers with poor credit often pay more than drivers with minor violations. This is one of the reasons shopping around is so important. Each insurer weighs these factors differently, and the cheapest company for one driver may be overpriced for another.

Liability-only car insurance is especially common in Illinois because many drivers own older vehicles with low market value. When a car is worth less than $4,000, full coverage often costs more than the vehicle itself over a few years. Dropping comprehensive and collision coverage can immediately cut premiums by 40–60%.

Liability-only policies are also common among retirees, low-mileage drivers, commuters with paid-off vehicles, and households insuring multiple cars. For these drivers, the goal is simple: stay legal, stay protected from lawsuits, and keep monthly costs as low as possible.

After reviewing statewide rate data, consumer satisfaction reports, and real-world quotes, several insurers consistently stand out for offering cheap liability car insurance in Illinois. These companies combine low base rates with flexible discounts and stable underwriting.

Westfield Insurance

Westfield is one of the cheapest liability insurers in Illinois, with average rates around $26 per month for qualified drivers. It operates as a regional carrier with lower overhead than national brands, allowing it to pass savings to low-risk drivers. Westfield is best suited for experienced drivers with clean records and good credit who don’t need flashy apps or heavy advertising.

Country Financial

Country Financial is headquartered in Illinois and has deep roots in the state. Average liability premiums hover around $42 per month. The company is known for excellent customer satisfaction, strong local agents, and competitive rates for families, seniors, and long-term policyholders.

Hanover Insurance

Hanover typically offers liability-only policies for around $49 per month. It performs especially well for urban drivers with good credit and clean records. Hanover is often overlooked, which makes it a smart comparison option when shopping for cheap coverage.

GEICO

GEICO remains one of the most competitive national insurers in Illinois, with average liability rates around $48 per month. The company excels in online convenience, fast quotes, and aggressive discounts for safe drivers, federal employees, and military members.

State Farm

State Farm averages about $51 per month for liability-only coverage in Illinois. While not always the absolute cheapest, it offers exceptional bundling discounts, the largest agent network in the state, and strong pricing for families and long-term customers.

These insurers form an excellent starting list, but the true cheapest option can only be found by comparing quotes side by side with identical coverage limits.

📊 State Farm in Illinois

Tip: The true cheapest option can only be found by comparing quotes side by side with identical coverage limits.

Teen drivers are the most expensive group to insure in Illinois. Inexperience, higher accident rates, and risk modeling push premiums sharply upward. Full coverage for a teen can exceed $5,000 per year, which is why many families choose liability-only policies for older vehicles.

The average Illinois teen pays about $1,032 annually, or roughly $86 per month, for liability-only insurance when added to a parent’s policy. Standalone policies cost significantly more.

Some of the most competitive insurers for Illinois teen drivers include:

The single biggest cost-saving strategy for teen drivers is staying on a parent’s policy. Maintaining a GPA of 3.0 or higher can reduce premiums by 10–20%. Completing an approved driver’s education course can stack additional savings, and safe driving habits over the first two years often lead to dramatic price drops.

Senior drivers often enjoy some of the cheapest liability insurance rates in Illinois due to decades of driving experience and lower annual mileage. Rates tend to bottom out between ages 55 and 70 before gradually increasing again after 75.

Many seniors pay between $39 and $50 per month for liability-only coverage. Insurers that consistently offer strong senior pricing include COUNTRY Financial, State Farm, GEICO, Mercury, and Progressive.

Illinois seniors can further reduce premiums by completing an approved defensive driving course, which typically provides a discount lasting up to three years. Retired drivers who log fewer miles should also report accurate mileage, as low usage significantly reduces risk in insurers’ eyes.

Where you live in Illinois has a major impact on how much you pay for liability insurance. Urban areas with high traffic density, theft rates, and claims frequency cost more to insure. Chicago drivers often pay 25–40% more than drivers in smaller towns.

Rural counties in southern and western Illinois tend to have the cheapest liability rates due to fewer accidents and lower repair costs. Even within Chicago, ZIP codes vary widely. Drivers who move just a few miles may see noticeable price differences at renewal.

Cheap liability insurance is rarely accidental. It’s the result of stacking multiple discounts. Many drivers miss savings simply because they never ask.

Telematics programs like GEICO DriveEasy, Progressive Snapshot, and State Farm Drive Safe & Save can reduce premiums by up to 30% for safe drivers. These programs track driving habits such as braking, acceleration, and mileage.

Bundling auto insurance with renters, homeowners, or life insurance often produces 10–25% savings. Even renters’ insurance policies costing under $15 per month can unlock substantial auto discounts.

Paperless billing, automatic payments, multi-vehicle policies, loyalty discounts, and safe-driver bonuses all add up. Maintaining continuous coverage is critical. Even a one-day lapse can raise Illinois premiums for years.

Illinois aggressively enforces its insurance laws. Driving without insurance can result in fines ranging from $500 to $1,000 for a first offense. Your license may be suspended for up to three months, and reinstatement requires proof of insurance and additional fees.

Repeat offenses bring harsher penalties, including longer suspensions and potential vehicle impoundment. Drivers caught uninsured after causing an accident face the most severe consequences. You may be personally liable for medical bills, vehicle repairs, legal costs, and court judgments that can follow you for decades.

Illinois also requires SR-22 filings after certain violations, which increase premiums significantly. Maintaining even basic liability coverage is far cheaper than dealing with the fallout of driving uninsured.

Insurance companies regularly adjust pricing models. What was cheap last year may be expensive today. Illinois drivers should compare quotes at least twice per year, ideally every six months at renewal.

Drivers who shop consistently often save 10% to 25% simply by switching carriers, even when their driving record hasn’t changed. Loyalty rarely pays in insurance unless paired with strong discounts.

While minimum coverage is the cheapest option, it isn’t always the smartest. Drivers with savings, property, or a steady income should strongly consider higher limits. Lawsuits don’t stop at policy limits, and Illinois allows injured parties to pursue the personal assets of those responsible.

For many drivers, 50/100/50 coverage strikes the best balance between affordability and protection. The modest monthly increase often provides thousands of dollars in extra security.

Despite rising rates, affordable liability car insurance in Illinois remains within reach. Whether you’re a teen driver starting, a family managing multiple vehicles, or a senior driving fewer miles, the key is informed comparison shopping.

Companies like Westfield Insurance, Country Financial, GEICO, State Farm, and Hanover Insurance continue to offer competitive liability rates under $50 per month for many Illinois drivers. By keeping coverage limits consistent, comparing at least five quotes, and actively pursuing discounts, you can stay legal, stay protected, and keep your monthly costs low.

Compare the cheapest liability car insurance quotes in Illinois in under five minutes. Start your online quote and see how easy it is to save hundreds with direct rates.